Loan Against

Property to fulfil

your dreams

Loan against property or LAP is a mortgage or secured loan availed after pledging a property as collateral. The interest rate starts from 9% p.a. You can avail of LAP up to 80% of property value for maximum of 15 years.

Loan Against Property Offers Starting @9% p.a.

You are just a few clicks away from the best offer on loan against property. Share your name, mobile number & email id to unlock customised property loan offers in your city. Compare and choose according to your specific requirements without any obligation.

Loan Against Property Offers Starting @9% p.a.

Easy approval & sanction

Loan against property is a secured loan and eligibility criteria are easy to meet. You can apply for high-ticket LAPs for education, business or personal reasons and avail of financing up to Rs. 15 crore with minimum hassles.

Attractive interest rates

The interest rate for a loan against property starts from 9% p.a. You get a higher loan amount at affordable EMI. Unlike personal loans, property loans cost less and offer greater repayment flexibility with longer tenure options.

Flexible tenure & EMI

A loan against property offers you maximum liquidity value for your property. You can avail of financing for up to 15 years. By choosing a long-tenure property loan, you get lower EMI option and ease of repayment.

View and improve your credit score - for free.

Know how good your score is

Get insights on how to improve it

Unlock offers as per your score

Financial tools

EMI Calculator

Find out exactly how much you need to pay for your next purchase

Loan Against Property Calculator

This calculator is useful in computing the EMI of a Loan Against Property.

Learn More About Loan against Property

✅ Loan against Property Details

Loan against Property (LAP) can be availed against the mortgage of a self-owned property for any personal or business purposes. The property acts as a collateral to support the finance provided by the lender. The margin for Loan against Property usually ranges from 50-90% of the value of the property (also known as LTV or Loan-to-Value).

✅ Features and Benefits of Loan Against Property

Each lender has their own eligibility criteria for availing LAP. Below are some common criteria to be eligible for a mortgage loan:

- Age: Minimum 21 years and maximum 65 years.

- Profession: Both self-employed individuals and salaried persons with a regular source of income are eligible for a Loan Against Property.

- Joint applications: Co-applicants are permissible. Lenders can accept the income of the co-applicants for arriving at the eligibility.

- Ownership:

- The applicant should have unencumbered property in their name. The property can be residential, commercial, or industrial.

- Agricultural land is not acceptable as security for the loan.

- Many banks stipulate that the property should either be vacant or self-occupied.

- Some of the banks do not consider a property that is let out on rent or lease to third parties.

- Some lending institutions sanction loan against vacant residential plots

- Margin: The margin requirement for Loan Against Property can be 10% to 50% of the market value of the property.

- Current obligations: The take-home pay norms come into effect. Usually, one should have a take-home pay of 50% after accounting for all the EMIs including the proposed one for the Loan against Property. Hence, it is imperative for the borrowers to declare their current obligations.

- Credit history: The lending banks are members of CIBIL (Credit Information Bureau (India) Limited). They can pull out the records from CIBIL to determine your credit score. Usually, a credit score in the range of 600 and above is acceptable.

✅ Mortgage Loan Interest Rate & Charges applicable by Property Type

- Upfront fees: Many banks follow the procedure of collecting upfront fees for processing the application. They adjust the fees with the processing fee in case they approve the loan. Remember, this is a non-refundable fee. It is usually in the range of Rs. 3,000 to Rs. 5,000.

- Processing fees: The regular processing fees are in the range of 0.50-1.00%.

- Valuation charges: Normally, these charges are included in the processing fees. But, some banks charge it as a separate entity. These charges are payable to the valuation engineer who determines the value of the property and submits the valuation report to the bank.

- Legal scrutiny charges: Similar to the valuation charges, some banks include these charges in the processing fees. At times, you have to incur these charges separately. It is payable to the advocate who conducts the legal search of the property and submits the Legal Scrutiny Report.

- Mortgage registration charges: Some states in India do not require the registration of the equitable mortgage. It is compulsory in states like Tamil Nadu. You have to incur these charges (0.5% of the loan amount subject to a maximum of Rs. 25,000 as stamp duty and Rs. 5,100 as equitable mortgage registration charges).

- Prepayment charges: Some banks charge prepayment charges to the tune of 2% to 5% of the outstanding loan It depends from bank to bank.

- Insurance: Insurance of the property to be mortgaged to the bank is compulsory. Also, some banks have tie-ups with insurance companies who market their products like loan insurance, health insurance, and personal accident coverage. These are optional charges.

You can also check Loan Against Property Interest Rate

✅ Loan Against Property Interest Rates of All Banks and NBFCs 2023

| Bank Name | Interest Rate | Processing Fees |

|---|---|---|

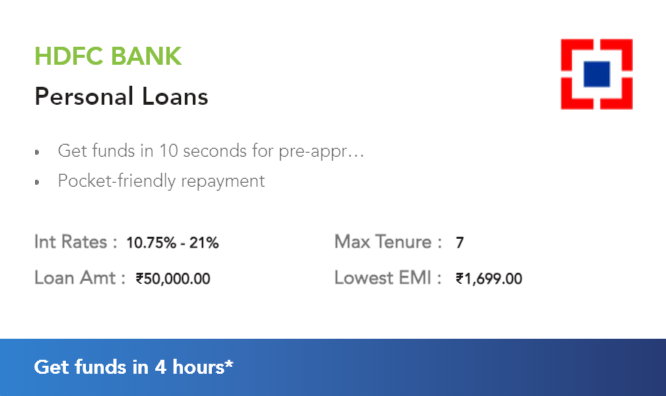

| HDFC Bank | 9.50% - 11.00% | Up to 1.50% of loan amount + taxes |

| IDFC First | 9.00% - 20.00% | Up to 3% of Loan Amount |

| HSBC Bank | 9.75% | 1% of loan amount + GST |

| Kotak Mahindra Bank | 9.50% - 10.50% | 1% of loan amount + GST |

| PNB Housing | 9.24% - 12.45% | 2% of loan amount + GST |

| State Bank of India | 10.10% - 11.65% | Up to 1% of loan amount |

| Federal Bank | 11.15% - 14.80% | 0.50% of loan amount |

| Home First | 12.80% - 18.50% | Rs 2,500 + GST |

| Bank of India | 10.10% | Up to 0.50% of loan amount |

| Bank of Baroda | 10.85% - 16.50% | Up to 1% of loan amount |

| IDBI Bank | 9.50% - 11.45% | 1% of loan amount |

| Central Bank of India | 9.75% - 13% | Up to 1% of loan amount |

| Bank of Maharashtra | 10.95% - 11.95% | 1% of loan amount + GST |

| Jammu & Kashmir Bank | 11.45% | Up to 1% of loan amount + GST |

| South Indian Bank | 13.15% - 14.40% | 1% of loan amount |

| YES Bank | 8.85% | Up to 1% of loan amount + GST |

✅ Loan against Property Process

✅ How to Get the Best Mortgage Loan?

✅ Types of Loan Against Property

Types of loan against property can be classified based on the purpose for which you avail the loan.

- Business Expansion Loans: Business entities can avail this facility for acquiring new machinery, purchase of plant, meeting working capital requirements, and invest in new technology or business. The lending banks require collateral in the form of property, residential, commercial, or industrial. Depending on the nature of the property available as collateral, the lending banks calculate the loan eligibility. For commercial properties, the LTV is around 55- 65%. In the case of industrial properties, the LTV reduces to 40-55% whereas the LTV in the case of residential property is in the range of 65-70%.

- Working Capital Overdraft Facility: Banks sanction overdraft facilities against the property for meeting the day-to-day working capital requirements. Under such circumstances, the property is accepted as collateral. Lending banks estimate the amount of finance required based on the following figures:

- Property value and nature of the property

- Actual working capital requirement calculated as per the internal policies of the bank, usually the Projected Annual Turnover method.

- Personal Expenses: Individuals can also avail Loan against the Property for personal expenses such as medical expenses, educational expenses, marriages, travel, as well as for purchasing consumer durables.

- Home Renovation: Usually, people do not avail this loan for renovating homes as there are separate schemes available at comparatively lower LAP interest rates. However, there can be circumstances when the borrower might have to resort to avail a Loan against Property for home renovation.

- Lease Rental Discounting: Some banks offer loans against the future rent receivables, especially in metropolitan and urban areas. One should note that the property that fetches the rent should also be mortgaged in favour of the bank. Banks usually finance in the range of 75% to 90% of the future lease/rent receivables. The tenure of such loans is shorter and should end before the expiry of the lease or the rental

✅ Mortgage Loan EMI Calculator

You can use the MyMoneyMantra EMI Calculator to calculate your Loan Against Property EMI. To do the EMI calculation, open our LAP EMI Calculator and just enter the details required to know the result. Along with the EMI, you also get a full chart showing the breakup of principal and interest repayment throughout the entire duration of the loan.

✅ Documents Required for Mortgage Loan

Following are the documents required for mortgage loan:

| Document Type | Documents Acceptable |

|---|---|

| Identity Proof |

|

| Address Proof |

|

| Income/Financial Documents |

|

| Property Documents: |

|

| Other Documents |

|

✅ Prepayment of Loan Against Property

The best part about loan against property is that you can prepay your loan before the end of the repayment tenure if you wish to. As per the RBI’s rules, this facility does not involve any prepayment charges if the loan is based on floating mortgage interest rates. For other variants, lenders may charge prepayment charges to the tune of 2% to 5% of the outstanding loan. It depends from bank to bank.

✅ Why Apply for a Loan against Property with MyMoneyMantra?

Many types of mortgage loans exist in the industry, i.e., mortgages, commercial mortgages, and industrial mortgages. Each bank has its product and interest rate. It is tedious to compare the products offered by a range of banks.

MyMoneyMantra can help you in this regard. We procure information from various sources and display it on a single screen thereby allowing you to compare a range of products. It helps you make an informed decision. We help you with other aspects of the deal like demographics, income and repaying capacity, and so forth.

At MyMoneyMantra, you have access to:

- The lowest rate of interest: The comparison on the screen allows you to choose the lowest rate on offer.

- Lowest processing fees: Usually, banks charge processing fees to the extent of 0.50-1%. As there is an involvement of a high amount, processing fees can constitute a significant chunk of your expenses.

- Easy documentation: The credit team at MyMoneyMantra helps in completion of documentation formalities.

- Higher Loan to Value Ratio (LTV): The LTV differs from bank to bank. At MyMoneyMantra, you will be able to compare the various margin rates and choose the one most suitable for you.

- Prepayment clauses: These are hidden charges that borrowers usually ignore. It can be in the range of 2-5%. MyMoneyMantra helps you compare the prepayment clauses of various banks and help you find the best choice.

- Transaction charges: LAP requires the creation of an equitable mortgage of property. It can cost you a lot of money ranging from advocate fee, evaluation fee, stamp duty on mortgage registration, and so on. Some banks include the advocate fee and evaluation fee in their processing fee structure whereas some banks charge separately. MyMoneyMantra helps you make this distinction and gets the deal most beneficial for you.

MyMoneyMantra has specialists who have experience of over 28 years in the field of Loan against Property and can help you:

- Assess your demographic and personal profile.

- Examine your previous repayment record.

- Understand the various terms used by bankers such as Legal Scrutiny Report (LSR), and the other policies of the banks in connection with a Loans against Property.

- Understand the fine print that people frequently overlook.

✅ What types of properties are accepted by lenders to provide Loan Against Property (LAP)?

✅ Which bank is best for loan against property?

ICICI, IDFC Bank, Kotak Bank, HDFC, SBI, Federal bank are some of the banks which are offering great deals on loan against property.

✅ What is a mortgage loan?

A mortgage loan is a loan provided by banks and other financial institutions against the mortgage of property or other assets for personal as well as business purposes.

✅ How can I apply for a mortgage loan?

You can apply for a mortgage loan through MyMoneyMantra, through the lender’s website, visiting the nearest branch of the loan provider or by calling on their customer care number.

✅ What is a reverse mortgage loan?

A Reverse Mortgage Loan is a credit facility which provides an additional income source to senior citizens of India, who have a self-owned or self-occupied home in India. It is a financial arrangement designed for senior citizens to fulfil their funding needs.

✅ What is the maximum loan tenure available under LAP?

Most lenders a maximum repayment tenure of 15 to 25 years for LAP.

✅ How much loan we can get against property?

You can get as much as 90% of property’s market value as a loan against your property, depending on your property’s value.

✅ Can NRIs avail loans against property?

Yes, NRIs as well as PIOs can get LAP in India if they are salaried, work for a reputed organization in selected countries and own a residential/commercial property in India.

✅ What is the difference between home loan and Loan Against Property?

A home loan is availed for the purchase/construction/renovation/repair of a residential house property whereas LAP is availed to fulfill any personal or business requirement just like a personal loan.

✅ How much CIBIL score is required for loan against property?

Individuals with a minimum CIBIL score of 600 or above acain avail LAP.

✅ How to get a loan against property without income proof?

✅ What is the process of Mortgage loan?

You can also check mortgage loan interest rate

✅ Can I get a mortgage loan with bad credit?

Yes. Being a secured loan, your application can be approved with a low credit score as well. You can also co-apply for the loan with your earning spouse or other co-applicants.