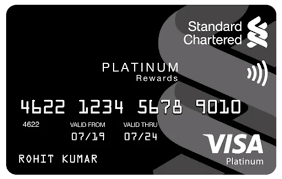

Platinum Rewards Credit Card

Card Type:

The Platinum Rewards Credit Card offers an exclusive rewards program for cardholders, providing significant benefits on every purchase across various categories including shopping, dining, and travel.

Key Highlights of Platinum Rewards Credit Card

- Earn reward points on every purchase.

- Exclusive offers at top merchants and brands.

- Annual fee waiver on spending above Rs. 2 Lakhs.

- Complimentary access to airport lounges.

Features & Benefits of Platinum Rewards Credit Card

Explore the exclusive features of the Platinum Rewards Credit Card:

Welcome Benefits

- Receive bonus reward points upon first transaction within the first month.

Reward Program

- 5 reward points for every Rs. 100 spent on shopping.

- 3 reward points for every Rs. 100 spent on dining.

- 1 reward point for every Rs. 100 spent on other transactions.

Lifestyle Benefits

- Access to exclusive dining offers and discounts.

- Complimentary airport lounge access across major cities.

Platinum Rewards Credit Card Fees & Charges

- Joining Fee: Rs. 1,500

- Annual Fee: Rs. 1,500 (waived on annual spends above Rs. 2 Lakhs)

- Interest on outstanding balance: 3.40% per month

- Cash advance fee: Rs. 300 per Rs. 10,000

- Foreign currency markup: 3.5%

Eligibility for Platinum Rewards Credit Card

- Primary cardholder should be aged between 21 and 65 years.

- Annual income of Rs. 6 Lakhs or above.

Documents Required

- Proof of identity: Aadhaar, PAN Card, Passport, etc.

- Proof of address: Aadhaar, Utility Bill, Passport, etc.

- Proof of income: Salary slips, Form 16, bank statements.

Reward Redemption

- Redeem reward points for exciting gifts, vouchers, and experiences through the Platinum rewards portal.

How to Apply for Platinum Rewards Credit Card?

- Visit the bank's website, fill out the application form, and provide necessary details.

- A Platinum representative will contact you to finalize the process.

Platinum Rewards Credit Card FAQs

Can I use my Platinum Rewards Card for cash withdrawals?

Yes, you can withdraw cash up to your limit. A cash advance fee of Rs. 300 per Rs. 10,000 will apply.

How can I redeem my reward points?

Redeem your points for gifts, shopping vouchers, and experiences via the Platinum rewards portal.

Can I increase my Platinum Rewards Credit Card limit?

Consistent usage and timely payments make you eligible for a credit limit increase, evaluated by the bank based on your profile.

What should I do if I lose my Platinum Rewards Credit Card?

Immediately report the loss to customer service to block your card and prevent unauthorized use.